Raising Capital Across the Startup Patent Gap

Growth stage startups with nascent patent holdings, typically focused on their core technology differentiation, often lack the defensive patents needed to face down incumbent patent holders and key established competitors. At this stage – often when seeking venture funding – startups without defensive IP can take a valuation hit from venture capital investors looking for solid patent portfolios as an early sign of viability. Without a patent portfolio to defend themselves, this patent gap creates a conundrum: given that startups require capital for scaling, they can’t spare capital to acquire defensive patents, and the lack of these patents becomes a drag on valuation. At the moment when startups are most enthusiastic about their growth prospects, a weak or nonexistent defensive IP portfolio can put their near-term valuation and long-term growth prospects at risk.

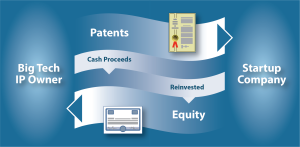

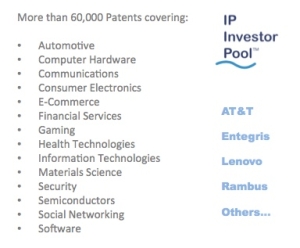

To bridge this gap, the IP Investor Pool enables an exchange of value between incumbent patent holders and high-growth startups that bridge the Startup Patent Gap for startups, provides them with access to strategic investors, and gives them a fundraising edge in Silicon Valley and beyond. The IP Investor Pool connects growing, venture-backed startups with valuable intellectual property from the industry’s most established, respected technology firms.

Conversely, more established technology firms often have diverse portfolios of IP from decades of research and development, acquisitions, and relationships in mature markets, but these portfolios are either are redundant or no longer relevant to their current business focus. Well-established and tested IP of this type would provide startups with excellent insulation against patent infringement suits, but at the same time serve as a costly drag on incumbent operators. And so, it can be more advantageous for well-established technology companies to exchange this IP for a strategic equity investment in a high-growth startup rather than to continue paying to maintain IP that is no longer core to their business.

Startups submit business plans to the pool as they would to a venture capital investor, at which point the team of patent experts at AQUA identify IP assets that will improve the defensive position of the company and contribute to its long-term growth and value potential. When a match is made, the IP is offered to the startup in exchange for equity, rather than cash, as part of their next-round of financing. This structure enables the startup to secure the Strategic IP Investment from the technology leader prior to pricing the financing round, allowing the benefits of the secured IP and strategic investment to be reflected in the valuation of that round. In many cases this allow for an immediately accretive acquisition of assets.

“Having recently closed our Series A1 funding round, we are excited about the concept of Strategic IP Investment as a means of filling out our defensive IP portfolio. We think the IP Investor Pool offers an innovative approach for the transfer of developed IP assets to the startups where they will deliver the greatest value. We look forward to working with AQUA as we prepare for our Series B round,” – Palaniswamy Rajan, CEO of SoftWear Automation.

“Venture Capitalists understand the significant impact that strong patent portfolios can have on exit valuations. It often can take longer to prosecute a patent portfolio than the gestation time a portfolio company may be under our investment tenure. The IP Investor Pool seems to have finally cracked the code on how to efficiently transfer strategic IP assets into startups where they can deliver the highest long-term value and do so when it can create the most value. We look forward to participation in the program with our portfolio companies.“-Charles Lax, Managing General Partner at GrandBanks Capital